Online loans are often associated with a short, maximum 14-day repayment period. However, there are commitments for a longer period on the market. To meet the expectations of customers, companies propose, among others loans for 30 days. Let’s check when it is profitable to take them and who can use them.

30 Day Loan popularity

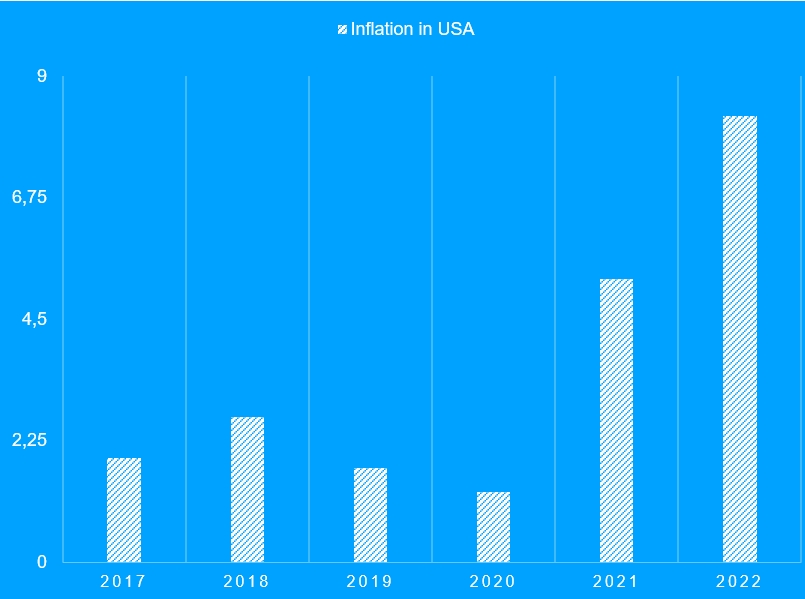

The need for payday loans is growing every day due to the increase in inflation over the past year. Thus, today inflation is 8.26 %, which is a record high for many years.

It is precise because of the lack of funds before the salary or some unexpected expenses that customers apply for payday loans to non-bank organizations.

People also lose confidence in the critical press, which quite often casts non-bank lending organizations in a negative light. Of course, some time ago, loan organizations were not under such regulation and there were scammers who did not act honestly. Today, the loan market is already one of the most developed and is not inferior to banks and credit unions.

If we talk about the portrait of the average user of loans, then this is a standard U.S. consumer. His key features are:

- average age 25 to 30;

- income per year is approximately $40,000;

- most of them have at least a high school education;

- employed, trying to build a good credit history;

- about half have their own housing.

Where can I apply for 30 day loans?

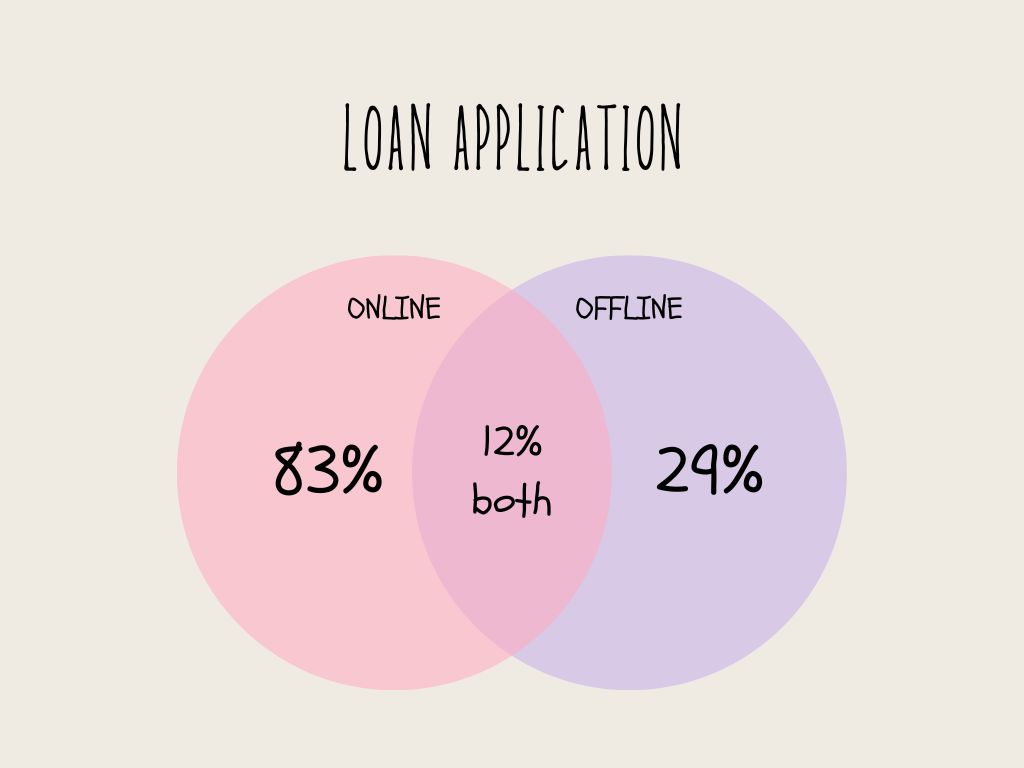

When applying for a loan, there are two most popular ways – online and in the lender’s branch. Recently, online loans are gaining more and more popularity due to the simplicity and speed of applying. According to statistics, 83% of users fill out an application online. 29% of citizens still use filing at the branch; usually these are pensioners or people who, in principle, prefer offline submission. 12% combine two filing methods, depending on the circumstances.

Advantages of 30-day loans

A few years ago, the offer of loan companies was associated with very unattractive conditions and a spiral of debt, due to excessively high fees and hidden costs. Borrowers often had to re-indebted themselves to be able to pay off their liabilities and not to struggle with bailiffs. The lender offer has changed in recent years, thanks to which loan customers can count on very attractive offers and enjoy immediate cash withdrawal without unnecessary fees. Do you want to know all the most important advantages of payday loans available?

Here is a list of the advantages of this type of offer:

- Online payday loans

You can receive money without leaving your home. Apply for a loan as well as conclude a contract entirely electronically. Thus, to receive a loan, you just need access to the Internet from any device, whether it be a phone, computer or tablet.

- Quick verification of the application and conclusion of the contract within several minutes

Thanks to modern technologies, the processing of your application takes a minimum of time, and the form itself requires a minimum of information and effort from you, so filling it out takes a maximum of 15 minutes.

- Withdrawal of money to the client’s bank account immediately after the conclusion of the contract

Of course, the working hours of the bank and the time of application also affect the transfer of money. Still, if you have an account in the same bank as the lender, then you can receive the necessary funds even on the same day.

- Payday loans available without credit history verification

For many clients, a bad credit history is an obstacle to applying to a bank. However, in order to receive a loan from a non-bank organization, you do not need to provide information about your creditworthiness, which is one of the most important advantages.

- Loans 24h /7 – you can apply for a loan even at night

Unforeseen circumstances are therefore unforeseen due to the fact that they can happen at any time of the day. That is why non-bank organizations work 24/7, even on weekends and holidays.

- A chance to conclude a promotional contract

The big advantage of payday loans is the possibility of getting the first loan free of charge with 0 % APR. Such a promotion is provided to new customers of the company and is a very advantageous offer.

30 day loan alternatives

There are some of the most common alternatives to payday loans on the financial market:

- installment and personal loans;

- banks;

- secured loans;

- private loans;

- pawn shops.

Installment loans

We must at this point distinguish between two terms. A typical payday loan is a liability that is repaid in one installment. The repayment period in our case 30 days.

Installment loans are a completely different product – the repayment is broken down into many months, which sometimes connects the borrower with the lender for years. Installment loans are offered with different repayment terms – the shortest is 3 months, and the longest even 36 months. A popular product in this category are loans for 12 months. With installment loans, you can apply for the amount up to $5,000.

If you want to borrow funds for a little longer, let’s know that it will be associated with higher costs and the need to remember to repay the loan in the form of monthly or weekly installments.

Personal loans

Personal loans are essentially no different from installment loans and are also repaid every month, but are issued for up to 60 months and in amounts up to $35,000.

Banks

A bank loan is nothing more than a written contract concluded between the consumer and the bank. On its basis, the bank undertakes to make a specified amount of money available for a specified period of time. On the other hand, the borrower is obliged to use the received funds in accordance with their intended purpose, specified terms of the contract, and to return them together with the remuneration due to the bank in the form of commissions and interest.

To apply for a bank loan, you must provide your income certificate and have a perfect credit history.

Secured loan

A secured loan is relatively convenient and beneficial financing that you can use if you are the owner of a real estate (apartment or house), plot, office, or car and you are looking for a large sum of funds to finance any purpose you choose.

As the name suggests, a secured loan must be secured. Therefore, there cannot be security established on the such property against another owner. Therefore, this is the best solution for the scenario when you are looking for a larger amount and at the same time have a property that you want to use as collateral.

Private loan

Simply put, private loans are a form of financial assistance that is not provided by any registered entities – but, as the name suggests, by private individuals. Hence, another term is equally popular: loans from private individuals. In the case of such financing, we will not meet the typical requirements known from banks or loan companies.

We are not dealing with any professional online platform, hotline, regulations and privacy policy, or even a short set of rules. We also do not undergo creditworthiness analysis. When deciding on a private loan, we must prepare for really different circumstances.

Pawn shops

Loans at a pawnshop are characterized by a short repayment period. They are usually granted for a period of seven to thirty days. During this time, the pledged item is in the pawnshop, but it is not his property.

Importantly, the pawnshop’s duty is to store the pledged item properly so that it returns to the owner intact after the loan has been repaid. It is obvious that the pledged item must have a certain value in order to become an attractive collateral. It can be jewelry, electronic equipment, works of art or household appliances.

How to take an online loan for 30 days?

The process of applying for a 30-day loan is very similar to a regular online payday loan.

To receive the money, follow the next steps:

- Go to the lender’s website.

- Choose the amount that suits you and the repayment date.

- Fill out the loan application, providing your personal details, bank account, home address and contact details.

- Verify your identity.

- Wait for the loan decision.

- Receive funds on your bank account if the application is positively verified.

What conditions must be met?

The basic conditions for receiving a 30-day payday loan are:

- 18 years old,

- valid ID card,

- American nationality,

- own bank account in an American bank,

- American mobile phone number,

- e-mail address,

- full legal capacity.

The borrower must also provide information on the amount of income earned. A mere declaration in this regard, in most cases, is enough to make a commitment.

Summary of the benefits of 30 day pay day loans

30 day payday loan is attractive in many ways. Above all:

- they are safe if we use the services of proven companies,

- allow you to borrow a relatively high amount up to $1,000,

- are also available to new customers of a given company,

- do not require the presentation of income certificates,

- all formalities can be done online,

- the liability is repaid once,

- the borrower is informed about the total cost of the commitment,

- the loan can be repaid in advance,

- companies offer many attractive offers for 30 day commitments.

Material Disclosure

FMSI.biz Notification

FMSI.biz serves solely as a bridge between borrowers and a network of lenders. We do not create loan agreements, make credit evaluations, or handle loan brokerage. Our platform does not impose service fees on users and is not an advocate for any participating lender of short-term loans. When you submit a request for a loan through our system, we facilitate the connection to independent lenders but do not assure a loan proposal will be made. Approval for a short-term loan via our website is not guaranteed. Lenders may perform credit inquiries with credit reporting bodies or receive credit reports from other sources. Lenders may request reports from major credit bureaus like Equifax, Experian, and TransUnion, or they may use other alternative credit information sources. Use of our website is entirely voluntary, and you are not required to engage with any lender or third party nor enter into a contract. The information provided here is for educational purposes and is not to be interpreted as legal counsel.

Clarification on Agency Role Please be advised that FMSI.biz is not a lending institution, does not issue loan offers, and is not engaged in the online loan brokering to lenders. We do not act as an agent or as a representative of any lender, nor do we take part in making credit decisions. Submitting a loan inquiry through our platform does not ensure that you will receive a loan offer or be approved for a loan. Some participating lenders might ask for documentation to be faxed. In certain cases, it might be necessary to visit a physical location to finalize your loan request process. Should you have queries regarding your loan, it is recommended to contact your lender directly.

APR Notice

State regulations may cap the Annual Percentage Rate (APR) that lenders are allowed to charge. APRs for different types of loans vary significantly. For cash advance loans, APRs may range from 200% up to 1386%, for installment loans the range is 6.63% to 485%, and for personal loans, APRs can be from 4.99% up to 450%, with variations depending on the lender. In states without APR restrictions or when borrowing from banks not subject to state regulations, the APR may be higher. The APR represents the annual cost of your loan, taking into account the total charge, the loan amount, the loan duration, repayment schedules, and the timing of payments. Before finalizing a loan agreement, lenders must disclose the APR and other loan terms to you by law. Please note that APRs are variable and may change.

Disclosure of Operations

This website is operated by a company that is not a direct lender, loan broker, or a representative of either. Our role is as a marketing referral service working with various lenders who may offer loan amounts ranging from $100 to $1,000 for cash advance loans, and even up to $35,000 for personal loans. The maximum amounts may not be available from all lenders, and there is no certainty that you will be matched with an independent lender who can meet your borrowing needs. This platform does not make loan offers but rather connects users with lenders. We do not charge for any product or service, nor do we represent any lender. Compensation may be given to us by lenders for advertising their services. We do not have any influence over lender actions and do not have access to full loan details, including APRs. Your lender is the best source for information about your loan terms, rates, fees, repayment schedules, and the implications of missed payments. Your registration details submitted here will be forwarded to one or more lenders. You are not required to engage our services to make contact with a lender, apply for credit, or accept a loan. Each lender’s money transfer and repayment terms will vary, and state and local laws may govern repayment terms. Some lenders may require faxing of documentation. Please consult our FAQs for further information on credit and payment delays. These disclosures are informational and should not be considered legal counsel. This service’s use aligns with this site’s Terms of Use and Privacy Policy.

Service Exclusions

Certain state residents may not qualify for short-term, small-dollar loans. Specifically, those from Arkansas, New York, New Hampshire, Vermont, and West Virginia are not eligible to use this service. The states where this service is available may change without prior notification.

Credit Considerations

This website’s operator is not involved in making credit decisions. Lenders you may connect with through this service might perform credit checks with credit reporting bureaus or obtain alternative reports to assess credit history, credit standing, and credit capacity. By submitting your details, you consent to allow lenders to verify your information and check your credit as needed. The loans offered by lenders in our network are intended for short-term financial relief and are not long-lasting financial solutions. Only take out a loan if it can be paid back by the upcoming pay cycle. For long-term financial health, it’s advisable to seek out professional financial guidance. Failing to repay loans on time may result in additional fees or collection activities. Every lender sets their own policies, so please review them for more information. If you do not repay your credit as agreed, lenders may pursue collection actions. Each lender’s policy on loan renewal varies, so it’s important to read and understand their terms.